It sometimes seems that killing a popular myth is like trying to cut water; it just doesn’t work. One all-pervading myth that refuses to die is the one where health insurance companies make their money by denying people’s claims. People from both parties have been caught repeating this line.

The ignorance reaches through several levels here. Not only do they not know what insurance is, they don’t even know how insurance companies actually work. Insurance really isn’t hard to understand, a group of people pay into a common pool of money according to a contract that contains specific terms about when someone gets awarded money from that pool. The people paying into the pool are essentially wagering that something will happen to trigger a cash payment to them before the sum total of all of their payments into the pool gets bigger than their maximum potential claim.

Insurance companies make their money by effectively investing that pool of funds. The more investment income an insurance company can make, the more claims it can pay out as well. Sometimes prudent investing is the difference between solvency and bankruptcy for these companies given that the average profit margin of a health insurance company is less than 5%.

So let’s say that you’re an insurance company. How far would you expect to get in business if you made it a habit of denying people’s claims? I think it would be safe to assume that if you denied someone’s claim, then it’s highly likely that they’re going to go find another insurance company. So what kind of a loss does that represent to you? Well, let’s just do the math.

It was recently reported that the average individual pays $107 to $301 per month in premiums. To an insurance company that’s something called an annuity and we can calculate what that’s worth fairly easily. What we want to know is what that annuity would grow in to over time. Since we’re working with averages, we’ll use the average lifetime of an American at birth of 78 years and the average market return of 10%.

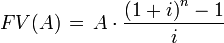

The formula for figuring it all out is:

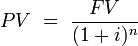

Where ‘A’ is the amount of the annuity, ‘i' is the interest rate per period and ‘n’ is the number of periods. Plugging our numbers in, we can see that a $100/month policy grows into a whopping $28.3 million, but the $300/month policy will eventually grow into a positively gargantuan $85 million. That's 78 years from now though, so what is that kind of money worth right now? Well, $16,743 and $50,228 when you use the following formula for the present value of a future sum of money:

That’s several times the size of your average insurance claim and it's a lot of money to risk forgoing in order to deny someone a claim of just about ANY size. Based on this alone it’s easy to state the following: Health insurance companies have a vested interest in keeping you alive and healthy for as long as possible.

After all, the money stops rolling in once you’re dead.

Now don’t worry all you insurance haters out there, I’m not going to take away one of your favorite scapegoats completely. Just call up your representative and ask them about the HMO Act, state mandated coverage, or why you can’t buy insurance from an out-of-state provider and how that isn't a violation of the interstate commerce clause.

No comments:

Post a Comment