December 31, 2010

December 30, 2010

December 22, 2010

The Kids are Not All Right

This piece from Katherine Birbalsingh is simply fantastic.

Ms. Kirbalsingh, a minority teacher in England's public school system and a former Marxist, details how her experiences with leftist policies transformed her to the "right wing."

The best part of the piece:

The regular dumbing-down of our examination system is obvious to any teacher who is paying attention and who has been in the game for some time. The refusal to allow children to fail at anything is endemic in a school culture that always looks after self-esteem and misses the crucial point, which is that children's self-esteem depends on achieving real success. If we never encourage them to challenge themselves by risking failure, self-esteem will never come.

I started to climb the professional teaching ladder, rising to positions of middle and senior management. There too I succeeded but often only by fighting against people's innate liberalism. Indeed, I would sometimes find myself arguing with my own deeply-embedded liberalism: "Take pity on the boy. Don't punish him. It isn't his fault he didn't do his homework; just look at his home situation." Or "Why ask them to do their ties to the top or tuck their shirts in? What does any of that have to do with learning?"

I had become indoctrinated by all the trendy nonsense dictating that if children are not behaving in your classroom, it is because you have been standing in front of them for more than five minutes trying to teach them. If only you had sat them in groups with you as facilitator, rather than teacher at the front, then you'd have the safe environment conducive to learning that we all seek. The basic ideology is that if there is chaos in the classroom, it is the teacher's fault. Children are not responsible for themselves, while senior management fails to establish systems that support teachers and punish children for not doing their homework, whatever their home situation.

I argued constantly with my colleagues and bosses. Often, I won and, almost as if they were inextricably linked, as the innate liberalism within people waned, the department or the school would improve. In every instance, I could see for myself that a move away from liberalism was a step in the right direction, a step that brought calm out of chaos, learning in place of trendiness, and success instead of failure.

Ms. Kirbalsingh, a minority teacher in England's public school system and a former Marxist, details how her experiences with leftist policies transformed her to the "right wing."

The best part of the piece:

The regular dumbing-down of our examination system is obvious to any teacher who is paying attention and who has been in the game for some time. The refusal to allow children to fail at anything is endemic in a school culture that always looks after self-esteem and misses the crucial point, which is that children's self-esteem depends on achieving real success. If we never encourage them to challenge themselves by risking failure, self-esteem will never come.

I started to climb the professional teaching ladder, rising to positions of middle and senior management. There too I succeeded but often only by fighting against people's innate liberalism. Indeed, I would sometimes find myself arguing with my own deeply-embedded liberalism: "Take pity on the boy. Don't punish him. It isn't his fault he didn't do his homework; just look at his home situation." Or "Why ask them to do their ties to the top or tuck their shirts in? What does any of that have to do with learning?"

I had become indoctrinated by all the trendy nonsense dictating that if children are not behaving in your classroom, it is because you have been standing in front of them for more than five minutes trying to teach them. If only you had sat them in groups with you as facilitator, rather than teacher at the front, then you'd have the safe environment conducive to learning that we all seek. The basic ideology is that if there is chaos in the classroom, it is the teacher's fault. Children are not responsible for themselves, while senior management fails to establish systems that support teachers and punish children for not doing their homework, whatever their home situation.

I argued constantly with my colleagues and bosses. Often, I won and, almost as if they were inextricably linked, as the innate liberalism within people waned, the department or the school would improve. In every instance, I could see for myself that a move away from liberalism was a step in the right direction, a step that brought calm out of chaos, learning in place of trendiness, and success instead of failure.

December 21, 2010

December 20, 2010

Danny Woodhead - My New Favorite Player

If you haven't been paying attention to Danny Woodhead of the New England Patriots, you are missing out on a great story.

Danny Woodhead is listed as 5 ft. 7 in., 190 lbs (this means he is 5 ft. 6 in., 180 lbs). He played his college football at Chadron State College (a Division II school in Chadron Nebraska).

He was cut from the NY Jets before the season started. The Patriots picked him up and he has been nothing short of amazing.

Here is a video of Woodhead trying to sell his own jersey to Patriot fans at Modell's:

Danny Woodhead is listed as 5 ft. 7 in., 190 lbs (this means he is 5 ft. 6 in., 180 lbs). He played his college football at Chadron State College (a Division II school in Chadron Nebraska).

He was cut from the NY Jets before the season started. The Patriots picked him up and he has been nothing short of amazing.

Here is a video of Woodhead trying to sell his own jersey to Patriot fans at Modell's:

December 17, 2010

Paul Ryan on the Tax Deal

I am really struggling with my position on the tax deal.

On one hand, I really find myself agreeing with what Mr. Quinn had to say on the issue.

However, Mr. Ryan in the speech delivered on the House floor is also very persuasive.

Sometimes you have to balance ideology with practicality, but if you do it too much and too often, you end up becoming a politician.

However, Mr. Ryan in the speech delivered on the House floor is also very persuasive.

Sometimes you have to balance ideology with practicality, but if you do it too much and too often, you end up becoming a politician.

Vanderbilt's Next Football Coach

I am an alumni of Vanderbilt and a former student-athlete.

We just hired a new football coach.

Here is an email I sent to the Director of Alumni relations outlining my thoughts on the hire:

Dear ________,

I hope you are having a great day and week.

Well, it looks like we have a new football coach at Vanderbilt.

I hope my instincts are completely wrong (it wouldn’t be the first time), but I think this decision and the process behind this decision was about as well thought out and executed as the decision for Vanderbilt to support President Obama’s Health Care legislation.

We just hired a new football coach.

Here is an email I sent to the Director of Alumni relations outlining my thoughts on the hire:

Dear ________,

I hope you are having a great day and week.

Well, it looks like we have a new football coach at Vanderbilt.

I hope my instincts are completely wrong (it wouldn’t be the first time), but I think this decision and the process behind this decision was about as well thought out and executed as the decision for Vanderbilt to support President Obama’s Health Care legislation.

I will hope against hope that James Franklin turns out to be the next great head coach in the SEC. That being said, I would be very curious to learn how the administration decided that James Franklin is qualified to be the next head coach at Vanderbilt.

You comment below that James Franklin is one of the nation’s “top offensive coordinators.” I would like to know what data set you studied to come to this conclusion?

In his three years as OC at Maryland, Coach Franklin’s offenses had an average ranking for total offense of 84 (out of 120 teams) and averaged roughly 23 points per game. Maryland' record in his time as OC has been 18-19.

So, in other words, roughly 70% of the offenses in the country had better numbers than Coach Franklin over the last three years, and let’s not forget that this was with the superior recruiting talents that Coach Franklin brings to the table.

In the two years he was OC at Kansas State, his offenses had an average ranking for total offense of 64 (out of 120 teams) and averaged 28 points per game. This was in a conference that played no defense and he had a first round NFL Quarterback in the two years he was calling plays. Kansas State's record in his time as OC was 12-13.

So, in other words, 53% of the offenses in the country had better offenses than Coach Franklin while at Kansas State. And let’s not forget that this was with the superior recruiting talent that Coach Franklin brings to the table.

So, all-in-all, we are looking at a coach with this resume:

No head coaching experience

No ties to the SEC

30-32 record as a signal caller

Average total offensive ranking of 74 out 120 teams

Average of 25 points per game

Just because Coach Franklin’s bio says he is one of the nation’s “top offensive coordinators” doesn’t make it so. When on average 61% of FBS teams have better offensive numbers than you, you statistically cannot be considered to be in the top.

Let’s also consider the fact that Coach Franklin doesn’t have one bit of experience in the SEC. I would be willing to bet that he has never even attended an SEC game or recruited below the Mason-Dixon line.

As for recruiting, I don’t doubt that Coach Franklin can bring in some better talent than the previous staff. However, let’s keep this in mind when it comes to recruiting at Vanderbilt. In order for Vanderbilt to have the 10th best recruiting class in the SEC, we would have to jump 20 spots in the recruiting rankings. If we wanted to have middle-of-the-road talent in the SEC, we would have to jump over 30 spots in the recruiting rankings. Given our academic requirements and other limitations, it is unlikely that we will ever be able to out-recruit anyone in the SEC.

With this in mind, I would like to think that Vanderbilt would realize that if you can’t out-talent someone, you have to outsmart them or out-scheme them.

The way you can outsmart or out-scheme someone is to do something unique and something that is difficult to prepare for. Coach Malzahn runs a unique offense. Ken N. at Navy runs a unique offense. Troy Calhoun at Air Force runs a unique offense. Dan Holgerson at Oklahoma State (now HC in waiting at West Virginia) runs a unique offense. Chip Kelly runs a unique offense. Mike Leach runs a unique offense.

Vanderbilt needs a system offense that can give us a competitive advantage against more talented teams.

Coach Franklin is going to be bringing his “Cheesecake Factory Offense” (CFO) with him to Vanderbilt.

The CFO is just like the experience you have at the restaurant. If you want Chinese, they got it. If you want Mexican, they got it. If you want Italian, they got it. Coach Franklin’s offense is very similar. If you want a little West Coast Offense, he’s got it. If you want a little Power O, he’s got it. If you want some Norv Turner stretch passing game, he’s got it. If you want some read option, he’s got it.

In fact, here is what Coach Franklin had to say about system offenses in an interview:

Tony: What are the trends you see developing in college football.

James: I see the end of “pure systems”. Teams are combining parts of different systems to come up with hybrid systems. For a while everyone was in love with the Spread but as defenses saw more of it they started to defend it much more effectively

I wonder if Coach Malzahn or Coach Kelly, the two offensive coaches calling plays in this year’s National Championship game, would agree with Coach Franklin’s assessment of the end of “pure systems.”

If you want to understand the advantage of having a system, see the below comments about Mike Leach’s “pure system” offense:

Last year, Tech averaged 60 passes a game so it is obviously not a balanced attack, but this actually works in their favor. In practice, they spend virtually all their time focusing on fundamentals related to the passing game. From the time they hit the practice field until they leave, the ball is in the air and the emphasis in on throwing, catching and protecting the quarterback.

It takes great confidence in your scheme to be able to take this approach, but the players appreciate it because they can focus on execution.

Practice -- What's Different

When you watch Texas Tech practice, it doesn't seem as structured as most college practices. They do not stretch as a team and unlike most practices, there is not a horn blowing every five minutes to change drills. The bottom line is that the cosmetic appearance of practice is not as important to Leach as it is to some coaches.

Although not as structured, it is impressive to watch Texas Tech practice and you quickly see why it is so successful. The ball is always in the air and what the Red Raiders practice is what you see them do in a game. They work on every phase of their package every day and in most passing drills, there are four quarterbacks throwing and every eligible receiver catching on each snap.

There is great detail given to fundamentals in all phases of the passing game. Wide receivers, for example, work every day on releases versus different coverages, ball security, scrambling drills, blocking and routes versus specific coverages.

I am not being negative just to be negative, but I cannot for the life of me find a solid reason to get behind the thought process of this hire.

How you make decisions is just as important as the outcome of those decisions because if the thought process is rational and reasoned, you can drastically increase the likelihood of positive outcomes.

If I am playing blackjack and I have 19 and the house is showing a 6, the right decision is to stay (this is not debatable). If I decide to go with my “gut” and hit and I pull a 2 out of my rear, that doesn’t mean I made a good decision. I simply got lucky and eventually bad outcomes will follow my errant thought process.

I hope James Franklin is the 2 to our 19, but I still can’t find a way to support the thought process behind this hire.

Please let me know where I have gone wrong.

Go Dores!

You comment below that James Franklin is one of the nation’s “top offensive coordinators.” I would like to know what data set you studied to come to this conclusion?

In his three years as OC at Maryland, Coach Franklin’s offenses had an average ranking for total offense of 84 (out of 120 teams) and averaged roughly 23 points per game. Maryland' record in his time as OC has been 18-19.

So, in other words, roughly 70% of the offenses in the country had better numbers than Coach Franklin over the last three years, and let’s not forget that this was with the superior recruiting talents that Coach Franklin brings to the table.

In the two years he was OC at Kansas State, his offenses had an average ranking for total offense of 64 (out of 120 teams) and averaged 28 points per game. This was in a conference that played no defense and he had a first round NFL Quarterback in the two years he was calling plays. Kansas State's record in his time as OC was 12-13.

So, in other words, 53% of the offenses in the country had better offenses than Coach Franklin while at Kansas State. And let’s not forget that this was with the superior recruiting talent that Coach Franklin brings to the table.

So, all-in-all, we are looking at a coach with this resume:

No head coaching experience

No ties to the SEC

30-32 record as a signal caller

Average total offensive ranking of 74 out 120 teams

Average of 25 points per game

Just because Coach Franklin’s bio says he is one of the nation’s “top offensive coordinators” doesn’t make it so. When on average 61% of FBS teams have better offensive numbers than you, you statistically cannot be considered to be in the top.

Let’s also consider the fact that Coach Franklin doesn’t have one bit of experience in the SEC. I would be willing to bet that he has never even attended an SEC game or recruited below the Mason-Dixon line.

As for recruiting, I don’t doubt that Coach Franklin can bring in some better talent than the previous staff. However, let’s keep this in mind when it comes to recruiting at Vanderbilt. In order for Vanderbilt to have the 10th best recruiting class in the SEC, we would have to jump 20 spots in the recruiting rankings. If we wanted to have middle-of-the-road talent in the SEC, we would have to jump over 30 spots in the recruiting rankings. Given our academic requirements and other limitations, it is unlikely that we will ever be able to out-recruit anyone in the SEC.

With this in mind, I would like to think that Vanderbilt would realize that if you can’t out-talent someone, you have to outsmart them or out-scheme them.

The way you can outsmart or out-scheme someone is to do something unique and something that is difficult to prepare for. Coach Malzahn runs a unique offense. Ken N. at Navy runs a unique offense. Troy Calhoun at Air Force runs a unique offense. Dan Holgerson at Oklahoma State (now HC in waiting at West Virginia) runs a unique offense. Chip Kelly runs a unique offense. Mike Leach runs a unique offense.

Vanderbilt needs a system offense that can give us a competitive advantage against more talented teams.

Coach Franklin is going to be bringing his “Cheesecake Factory Offense” (CFO) with him to Vanderbilt.

The CFO is just like the experience you have at the restaurant. If you want Chinese, they got it. If you want Mexican, they got it. If you want Italian, they got it. Coach Franklin’s offense is very similar. If you want a little West Coast Offense, he’s got it. If you want a little Power O, he’s got it. If you want some Norv Turner stretch passing game, he’s got it. If you want some read option, he’s got it.

In fact, here is what Coach Franklin had to say about system offenses in an interview:

Tony: What are the trends you see developing in college football.

James: I see the end of “pure systems”. Teams are combining parts of different systems to come up with hybrid systems. For a while everyone was in love with the Spread but as defenses saw more of it they started to defend it much more effectively

I wonder if Coach Malzahn or Coach Kelly, the two offensive coaches calling plays in this year’s National Championship game, would agree with Coach Franklin’s assessment of the end of “pure systems.”

If you want to understand the advantage of having a system, see the below comments about Mike Leach’s “pure system” offense:

Last year, Tech averaged 60 passes a game so it is obviously not a balanced attack, but this actually works in their favor. In practice, they spend virtually all their time focusing on fundamentals related to the passing game. From the time they hit the practice field until they leave, the ball is in the air and the emphasis in on throwing, catching and protecting the quarterback.

It takes great confidence in your scheme to be able to take this approach, but the players appreciate it because they can focus on execution.

Practice -- What's Different

When you watch Texas Tech practice, it doesn't seem as structured as most college practices. They do not stretch as a team and unlike most practices, there is not a horn blowing every five minutes to change drills. The bottom line is that the cosmetic appearance of practice is not as important to Leach as it is to some coaches.

Although not as structured, it is impressive to watch Texas Tech practice and you quickly see why it is so successful. The ball is always in the air and what the Red Raiders practice is what you see them do in a game. They work on every phase of their package every day and in most passing drills, there are four quarterbacks throwing and every eligible receiver catching on each snap.

There is great detail given to fundamentals in all phases of the passing game. Wide receivers, for example, work every day on releases versus different coverages, ball security, scrambling drills, blocking and routes versus specific coverages.

I am not being negative just to be negative, but I cannot for the life of me find a solid reason to get behind the thought process of this hire.

How you make decisions is just as important as the outcome of those decisions because if the thought process is rational and reasoned, you can drastically increase the likelihood of positive outcomes.

If I am playing blackjack and I have 19 and the house is showing a 6, the right decision is to stay (this is not debatable). If I decide to go with my “gut” and hit and I pull a 2 out of my rear, that doesn’t mean I made a good decision. I simply got lucky and eventually bad outcomes will follow my errant thought process.

I hope James Franklin is the 2 to our 19, but I still can’t find a way to support the thought process behind this hire.

Please let me know where I have gone wrong.

Go Dores!

December 8, 2010

Was the Tax Compromise a Win?

According to James Quinn, no it was not:

I’m a big fan of Clint Eastwood movies. Below are two of the greatest scenes in movie history, with two of the greatest, most quoted lines in history. The lines are:

I’m a big fan of Clint Eastwood movies. Below are two of the greatest scenes in movie history, with two of the greatest, most quoted lines in history. The lines are:

“Go ahead, make my day.”

and

“You’ve got to ask yourself one question: Do I feel lucky? Well, do ya, punk?”

For some strange reason these two lines came to my mind as I watched President Obama announce the Great Tax Compromise of 2010. In both scenes the criminals came to their senses when confronted with Dirty Harry. Our criminal Congress and criminal president reached for the gun, because they feel lucky. We know what happens next when confronted with a .44 Magnum.

Obama and his new Republican friends agreed to add $1 trillion to the national debt in the next two years. That is 30% of our entire budget and 7% of GDP. Here are some words of wisdom on this subject, spoken a few years ago:

“Deficits mean future tax increases, pure and simple. Deficit spending should be viewed as a tax on future generations, and politicians who create deficits should be exposed as tax hikers.” – Ron Paul

I have no issue with low taxes. I would like lower taxes. But, we’ve all become Keynesians if we agree with the “compromise” that was reached yesterday. Republicans have not kept taxes low. They’ve insured that future generations will have higher taxes so they can enjoy the good times in 2011 and 2012.

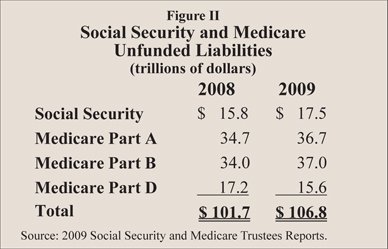

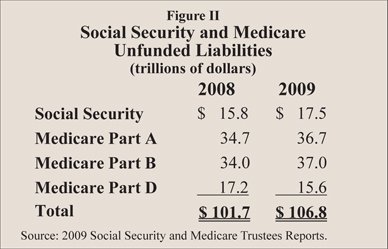

The big surprise was the 2% payroll “tax cut” for 2011. The social security tax would be reduced from 6.2% to 4.2% for one year. This will provide a tax cut of $1,000 for the average American family making the median income of $50,000. It will cost $120 billion. This is certainly an interesting idea when social security has already promised to pay out $17.5 trillion more than it will ever bring in. The Washington, D.C., politician solution to a massive entitlement liability is to make it larger, so that we can buy a new 52 inch HDTV today.

A $1,000 tax cut comes to $20 per week for the average family. Now here is where the Federal Reserve and their politician protectors in Congress and the White House get you while you are not looking. As the world realizes that American politicians have no intention of cutting deficits, the U.S. dollar will continue to weaken. This is what Ben Bernanke wants. It makes our debt burden easier to pay back while screwing our foreign lenders. The result of the weakening dollar has been a dramatic surge in oil and food prices. The average American family drives 25,000 miles per year in two cars. The average car gets 20 mpg. Therefore, the average family is using 1,250 gallons of gas per year. Gas prices are at a two year high and will go higher as the dollar weakens. The entire $1,000 “tax cut” will be utilized to pay the higher price for gas. This doesn’t take into account the much higher food prices headed down the track, along with higher cost for all the stuff we import.

The ruling elite have convinced you that the tax cut will benefit you, when the inflation they have created has actually made your poorer. Thank you sir may I have another.

The 10-year Treasury surged 16 basis points this morning to 3.08%. This is the highest level since July and is now up .68% since Ben Bernanke indicated QE2 was on the way. QE2 was supposed to reduce long term interest rates. Mortgage rates are going up, not down. Housing prices are already in free-fall again. Higher mortage rates will destroy the housing market. Obama, Bernanke and Congress have created the perfect storm. Keep partying today, for tomorrow will be painful.

December 6, 2010

Bye Bye Bake Sales

From Paul Jacob's blog:

It sounded like a good idea — Michelle Obama would get involved in a campaign to reduce childhood obesity. Obesity is a problem, yes, and a good cause for the First Lady. But, today, advocacy must always be paired with legislation.

An AP news story provides all you really need to know:

A child nutrition bill on its way to President Barack Obama — and championed by the first lady — gives the government power to limit school bake sales and other fundraisers that health advocates say sometimes replace wholesome meals in the lunchroom.

So now we are to have federal government’s micro-mismanagement reach far beyond the curriculum. The basic idea being . . . give up on parents. Give up on local control. Go, Washington!

Our national nannies took special care with the bill’s language, adding the category of school fundraisers as a special target of the regulations. Apparently, they can’t stand the fact that, on special occasions, mothers and fathers bake up sugary treats to sell, to support special school activities that affect their kids.

I guess they want us to sell broccoli.

Yup. That’ll send the school band to Disneyland.

The whole bill is a bad idea, and not just because Washington can’t tell special occasions from one’s day-in/day-out diet. The very singling out of special fundraisers for federal attention shows just how far into our lives Washington’s busybodies believe they can insert themselves.

An AP news story provides all you really need to know:

A child nutrition bill on its way to President Barack Obama — and championed by the first lady — gives the government power to limit school bake sales and other fundraisers that health advocates say sometimes replace wholesome meals in the lunchroom.

So now we are to have federal government’s micro-mismanagement reach far beyond the curriculum. The basic idea being . . . give up on parents. Give up on local control. Go, Washington!

Our national nannies took special care with the bill’s language, adding the category of school fundraisers as a special target of the regulations. Apparently, they can’t stand the fact that, on special occasions, mothers and fathers bake up sugary treats to sell, to support special school activities that affect their kids.

I guess they want us to sell broccoli.

Yup. That’ll send the school band to Disneyland.

The whole bill is a bad idea, and not just because Washington can’t tell special occasions from one’s day-in/day-out diet. The very singling out of special fundraisers for federal attention shows just how far into our lives Washington’s busybodies believe they can insert themselves.

December 2, 2010

December 1, 2010

Avoid Facebook - Save Your Marriage

Headline from an article in Britain's Daily Mail: The marriage killer: One in five American divorces now involve Facebook

From the article:

It used to be the tell-tale lipstick on the collar. Then there were the give-away texts that spelled the death knell for many marriages.

But now one in five divorces involve the social networking site Facebook, according to a new survey by the American Academy of Matrimonial Lawyers.

From the article:

It used to be the tell-tale lipstick on the collar. Then there were the give-away texts that spelled the death knell for many marriages.

But now one in five divorces involve the social networking site Facebook, according to a new survey by the American Academy of Matrimonial Lawyers.

.......Flirty messages and photographs found on Facebook are increasingly being cited as proof of unreasonable behaviour or irreconcilable differences.

Many cases revolve around social media users who get back in touch with old flames they hadn’t heard from in many years.

Many cases revolve around social media users who get back in touch with old flames they hadn’t heard from in many years.

Facebook was by far the biggest offender, with 66 per cent of lawyers citing it as the primary source of evidence in a divorce case. MySpace followed with 15 per cent, Twitter at 5 per cent and other choices lumped together at 14 per cent.

November 23, 2010

Staggering Chart and Stats

From Tim Challies:

Seven hundred billion minutes. That’s how much time Facebook’s 500 million active users spend on the site every month. 700,000,000,000 minutes. Let that one sink in for a moment. Every month we spend the equivalent of 1.3 million years on Facebook; the equivalent of nearly 18,000 lifetimes. More than half of us login every single day; we average 130 friends. And we spend vast amounts of time on there.

Facebook now offers 900 million different objects or pages for us to interact with—groups, events, community pages, and so on. We upload over 3 billion photographs every month (which means we’re uploading millions every hour).

[. . .]

So think about this one. Four years ago most of us did not use Facebook at all. And today we are using it compulsively. A recent study of media habits found that about 1/3 of women between 18 and 34 check Facebook before they even go to the bathroom in the morning; 21% check it in the middle of the night; half of them admit that they are addicted to it. Meanwhile the older generations, those in their 40’s and 50’s, are also migrating to social media; they now represent the fastest-growing population.

But again, 4 years ago most of us did not use it at all. We may have heard the name, but it was just a name. Today it’s a way of life. What’s important to think about is the fact that Facebook is not a site that offers us a better way of doing what we were already doing. It’s not like most of us were on another social media site and we then migrated once Facebook came along (with young people being a possible exception; many of them migrated from MySpace to Facebook). For the majority of us, Facebook is a new thing. Those 700 billion minutes are not minutes that we’ve taken away from other online pursuits. They are minutes that we’ve taken away from real life.

Seven hundred billion minutes. That’s how much time Facebook’s 500 million active users spend on the site every month. 700,000,000,000 minutes. Let that one sink in for a moment. Every month we spend the equivalent of 1.3 million years on Facebook; the equivalent of nearly 18,000 lifetimes. More than half of us login every single day; we average 130 friends. And we spend vast amounts of time on there.

Facebook now offers 900 million different objects or pages for us to interact with—groups, events, community pages, and so on. We upload over 3 billion photographs every month (which means we’re uploading millions every hour).

[. . .]

So think about this one. Four years ago most of us did not use Facebook at all. And today we are using it compulsively. A recent study of media habits found that about 1/3 of women between 18 and 34 check Facebook before they even go to the bathroom in the morning; 21% check it in the middle of the night; half of them admit that they are addicted to it. Meanwhile the older generations, those in their 40’s and 50’s, are also migrating to social media; they now represent the fastest-growing population.

But again, 4 years ago most of us did not use it at all. We may have heard the name, but it was just a name. Today it’s a way of life. What’s important to think about is the fact that Facebook is not a site that offers us a better way of doing what we were already doing. It’s not like most of us were on another social media site and we then migrated once Facebook came along (with young people being a possible exception; many of them migrated from MySpace to Facebook). For the majority of us, Facebook is a new thing. Those 700 billion minutes are not minutes that we’ve taken away from other online pursuits. They are minutes that we’ve taken away from real life.

November 22, 2010

November 15, 2010

Dear Ben

Good day and compliments. I am Dr (Mr) Benjamin Bernanke, Chairman of Federal Reserve of United States of America. This mail will surely come to you as a great surprise, since we never had any previous correspondence. My aim of contacting you is to crave your indulgence to assist us in securing some funds abroad to prosecute a transaction of great magnitude.

Due to poor banking system in America, many subprime borrowers are not paying back mortgages and banks have lost ONE TRILLION TWO HUNDRED BILLION UNITED STATES DOLLARS ($1,200bn) so far. This calamity has caused much suffering in my country. To help remedy this situation, our president, Mr Barack Obama, has authorised to be spent a sum of EIGHT HUNDRED NINETY SEVEN BILLION DOLLARS ($897bn) on stimulus plus many other good deeds like cash for clunkers. Unfortunately, since that time, we are being molested and constantly harassed by bond vigilantes who do not care that their reckless and vicious behaviour could ruin our hopes and plans.

To this effect, last year I authorised the printing of ONE TRILLION TWO HUNDRED AND FIFTY BILLION ($1,250bn) of United States currency to purchase government securities. To my great shock, this was not enough so I am now buying another SIX HUNDRED BILLION DOLLARS ($600bn).

If you forward a modest sum to purchase Treasury notes then I can buy many more of them with my unlimited printing press and their price will rise. I am absolutely positive that this arrangement will be of mutual benefit to both of us. I can offer you generous interest rate of EIGHT TENTHS OF A PERCENT after taxes.

I want you to immediately inform me of your willingness in assisting and co-operating with us, so that I can send you full details of this transaction and let us make arrangement for a meeting and discuss at length on how to transfer this funds.

Yours Faithfully,

Dr (Mr) Benjamin Bernanke

N/B: Please contact Mr Timothy Geithner on this e-mail address for further briefing and modalities.

November 8, 2010

Oh, the Irony

Who would have ever thought that the United States of America would be receiving a lecture from the Chinese and Germans on the ill effects of a planned economy:

China's Vice-Foreign Minister Cui Tiankai said last Friday that the US step may hurt global confidence, while rejecting state-planning style targets for trade deficits.

.........But on Thursday and Friday, governments focused instead on the global impact of the Fed’s action. “With all due respect, US policy is clueless,” Wolfgang Schäuble, German finance minister, told reporters. “It’s not that the Americans haven’t pumped enough liquidity into the market,” he said. “Now to say let’s pump more into the market is not going to solve their problems.”

China's Vice-Foreign Minister Cui Tiankai said last Friday that the US step may hurt global confidence, while rejecting state-planning style targets for trade deficits.

.........But on Thursday and Friday, governments focused instead on the global impact of the Fed’s action. “With all due respect, US policy is clueless,” Wolfgang Schäuble, German finance minister, told reporters. “It’s not that the Americans haven’t pumped enough liquidity into the market,” he said. “Now to say let’s pump more into the market is not going to solve their problems.”

November 4, 2010

Obama and FDR

From Burt Fulsom:

The 60+ House seats that the Democrats lost this week is the greatest loss for a party in power since FDR’s Democrats lost 81 seats in 1938. The circumstances of both losses are similar.

For example, shortly after FDR lost his 81 seats, Robert Doughton, the Democratic chairman of the House Ways and Means Committee, made this comment: “I don’t believe that generations which so far haven’t a chance to vote or to get born should be paying off our headaches.” FDR had almost doubled the national debt in his first six years in the White House, and Doughton was sad that his grandchildren–who may well be alive today–would have to pay the debts accumulated by FDR’s failed spending programs. The large debt being accumulated today under President Obama will have to be paid off by the grandchildren of Congressman Doughton’s grandchildren. FDR transferred pieces of his debt to us, and now we will transfer debts from the stimulus package and the various bailouts to our grandchildren. Voters in 1938 and in 2010 were both saying “no” to more debt. That is a reason for hope.

Interestingly, the groups in the country most supportive of FDR in 1938 and Obama in 2010 are from the areas of the country struggling the most financially. In Alabama and Mississippi, for example, the Democrats controlled all seats in Congress in 1938, and both states voted overwhelmingly for FDR. Yet they were among the poorest states in the U. S. in 1938. Today, California, with its $138 billion in debt, and Nevada, with its near 14 percent unemployment rate, have supported the Democrats most enthusiastically in 2010. Perhaps the states with the weakest level of entrepreneurship are the most anxious to vote to transfer tax money to their states from the wealthier states with more profitable economies.

College Degree - Worth It?

Richard Vedder with the Chronicle of Higher Education recently reported the following statistics:

Over 317,000 waiters and waitresses have college degrees (over 8,000 of them have doctoral or professional degrees), along with over 80,000 bartenders, and over 18,000parking lot attendants. All told, some 17,000,000 Americans with college degrees are doing jobs that the BLS says require less than the skill levels associated with a bachelor’s degree.

Over 317,000 waiters and waitresses have college degrees (over 8,000 of them have doctoral or professional degrees), along with over 80,000 bartenders, and over 18,000parking lot attendants. All told, some 17,000,000 Americans with college degrees are doing jobs that the BLS says require less than the skill levels associated with a bachelor’s degree.

Vedder goes on to state:

I have long been a proponent of Charles Murray’s thesis that an increasing number of people attending college do not have the cognitive abilities or other attributes usually necessary for success at higher levels of learning. As more and more try to attend colleges, either college degrees will be watered down (something already happening I suspect) or drop-out rates will rise.

.........This week an extraordinarily interesting new study was posted on the Web site of America’s most prestigious economic-research organization, the National Bureau of Economic Research. Three highly regarded economists (one of whom has won the Nobel Prize in Economic Science) have produced “Estimating Marginal Returns to Education,” Working Paper 16474 of the NBER. After very sophisticated and elaborate analysis, the authors conclude “In general, marginal and average returns to college are not the same.” (p. 28)

In other words, even if on average, an investment in higher education yields a good, say 10 percent, rate of return, it does not follow that adding to existing investments will yield that return, partly for reasons outlined above. The authors (Pedro Carneiro, James Heckman, and Edward Vytlacil) make that point explicitly, stating “Some marginal expansions of schooling produce gains that are well below average returns, in general agreement with the analysis of Charles Murray.” (p.29)

...........Yet, at a time when resources are scarce, when American governments are running $1.3-trillion deficits, when we face huge unfunded liabilities associated with commitments made to our growing elderly population, should we be subsidizing increasingly problematic educational programs for students whose prior academic record would suggest little likelihood of academic, much less vocational, success?

I think the American people understand, albeit dimly, the logic above. Increasingly, state governments are cutting back higher-education funding, thinking it is an activity that largely confers private benefits. The pleas of university leaders and governmental officials for more and more college attendance appear to be increasingly costly and unproductive forms of special pleading by a sector that abhors transparency and performance measures.

Higher education is on the brink of big change, like it or not.

I have long been a proponent of Charles Murray’s thesis that an increasing number of people attending college do not have the cognitive abilities or other attributes usually necessary for success at higher levels of learning. As more and more try to attend colleges, either college degrees will be watered down (something already happening I suspect) or drop-out rates will rise.

.........This week an extraordinarily interesting new study was posted on the Web site of America’s most prestigious economic-research organization, the National Bureau of Economic Research. Three highly regarded economists (one of whom has won the Nobel Prize in Economic Science) have produced “Estimating Marginal Returns to Education,” Working Paper 16474 of the NBER. After very sophisticated and elaborate analysis, the authors conclude “In general, marginal and average returns to college are not the same.” (p. 28)

In other words, even if on average, an investment in higher education yields a good, say 10 percent, rate of return, it does not follow that adding to existing investments will yield that return, partly for reasons outlined above. The authors (Pedro Carneiro, James Heckman, and Edward Vytlacil) make that point explicitly, stating “Some marginal expansions of schooling produce gains that are well below average returns, in general agreement with the analysis of Charles Murray.” (p.29)

...........Yet, at a time when resources are scarce, when American governments are running $1.3-trillion deficits, when we face huge unfunded liabilities associated with commitments made to our growing elderly population, should we be subsidizing increasingly problematic educational programs for students whose prior academic record would suggest little likelihood of academic, much less vocational, success?

I think the American people understand, albeit dimly, the logic above. Increasingly, state governments are cutting back higher-education funding, thinking it is an activity that largely confers private benefits. The pleas of university leaders and governmental officials for more and more college attendance appear to be increasingly costly and unproductive forms of special pleading by a sector that abhors transparency and performance measures.

Higher education is on the brink of big change, like it or not.

October 27, 2010

Tom Brown - Enough With the Loan Mods!

I thought the article below from Bankstock.com's Tom Brown was worth posting in full:

“We know how to prevent foreclosures,” Paul Willen, a senior economist from the Boston Fed, said at a housing conference in Washington yesterday. “We just need to be prepared to spend the money.”

Just “be prepared to spend the money”! Economists sometimes make things sound so simple, don’t they? Alas, I have a sense that the “we” Willen was referring to when he was pointing out who should be prepared to do the paying included more than just himself and the other Fed economists in the room. He was being more expansive. Willen meant all of us. Taxpayers. We’re the ones, according to the Beltway conventional wisdom Willen yesterday found himself spouting, who ought to be shelling out money to pay for large-scale loan modifications so that delinquent borrowers to can stay in their homes and “prevent foreclosures.”

Thanks for the insight, Paul! Now, I have a question: Why me? I have my own mortgage, thanks very much. Why do I have to be on the hook for someone else’s, too? If a delinquent borrower, through bad luck or bad judgment, finds himself unable to meet a loan agreement that he freely entered into, let him go through the same thing that generations of defaulted borrowers before him have: foreclosure. No one’s being thrown in jail or being forced to listen to Justin Beiber. You borrowed money from a bank, with your house as collateral. You can’t repay your loan. The bank gets your house. It’s time to move on. Literally.

Do I sound too hard-hearted? Well, if you’re asking me to help finance an alternate transaction—a loan mod—I have a right to, don’t I? And, anyway, for all the sad-sackery we’ve had to listen for the past three years about the tragedy of families losing their homes as a result of the housing blowup, what, really, is so bad about foreclosure, from a borrower’s perspective? The typical defaulted borrower is a year-and-a-half behind on his mortgage by the time eviction finally happens—which means that that’s how long he’s been able to live rent-free. On the face of it, that doesn’t sound like a bad deal. And if the property is located in a market that’s depressed economically (which it likely is), the borrower is unchained from it at last, and can pick up and move to somewhere with a better jobs outlook. Why’s that bad? It’s a hassle, sure, and embarrassing. Life’s full of hassles and embarrassments. But foreclosure is a fresh start, too, and one that solves both the borrower’s and the bank’s problem the most economical way possible. Why do I (and the bank) have to foot the bill for an alternative—especially since the odds are overwhelming that borrower will go ahead a default on the modified loan, too?

Washington’s fetishisation of loan modifications as a cure-all for the housing bust is idiotic. If the housing bubble and crash taught us anything, it’s that home ownership is not a right. Defaulted borrowers don’t deserve extraordinary taxpayer- (or lender-) financed measures that will allow them to stay in their homes. They deserve to be foreclosed on. Let the cycle take its course, and leave my wallet out of it.

Not Union Jack - Union Mohammed

From Britain's Daily Mail:

Mohammed is now the most popular name for newborn boys in England and Wales ahead of Jack and Harry, it emerged today.

The name, when 12 different spellings were included, was given to 7,549 youngsters in 2009, official statistics revealed.

Oliver was the second most popular and it was given to 7,364 boys in England and Wales in 12 months.

Mohammed is now the most popular name for newborn boys in England and Wales ahead of Jack and Harry, it emerged today.

The name, when 12 different spellings were included, was given to 7,549 youngsters in 2009, official statistics revealed.

Oliver was the second most popular and it was given to 7,364 boys in England and Wales in 12 months.

October 17, 2010

Passing Your Way to Victory?

The conventional wisdom in college football today is that if you are not a pass oriented offense, you will struggle to win, attract recruits, excite fans, etc., et.c, etc.

Maybe we should take Sherlock Holmes' advice of not theorizing before we have the data (from Coach Wyatt's blog)

(1) Halfway through this season, in the list of the top 25 major college rushing teams (yards per game), there is not one with a losing record; you have to go clear to number 28 before finding one (Wake Forest, at 2-4).

(2) Among the top major college passing teams, however, there are three teams in the top 25 with losing records: Duke at 15, Central Michigan at 18 and Arkansas State at 24.

(3) The Top 10 rushing teams have an overall record of 50-8 (.862) ; the Top 10 passing teams are 35-15 (.700)

(4) The Top 25 rushing teams are 116-30 overall (.795) ; the Top 25 passing teams are 83-48 (.633)

Maybe we should take Sherlock Holmes' advice of not theorizing before we have the data (from Coach Wyatt's blog)

(1) Halfway through this season, in the list of the top 25 major college rushing teams (yards per game), there is not one with a losing record; you have to go clear to number 28 before finding one (Wake Forest, at 2-4).

(2) Among the top major college passing teams, however, there are three teams in the top 25 with losing records: Duke at 15, Central Michigan at 18 and Arkansas State at 24.

(3) The Top 10 rushing teams have an overall record of 50-8 (.862) ; the Top 10 passing teams are 35-15 (.700)

(4) The Top 25 rushing teams are 116-30 overall (.795) ; the Top 25 passing teams are 83-48 (.633)

October 16, 2010

Uh-Oh

The information below came from John Mauldin's latest letter. The excerpt below was an email sent to one of Mauldin's friends. The person who sent the email is in the financial services industry:

This is very long, but I think it's extremely important that you ready every word of it:

"Homeowners can only be foreclosed and evicted from their homes by the person or institution who actually has the loan paper...only the note-holder has legal standing to ask a court to foreclose and evict. Not the mortgage, the note, which is the actual IOU that people sign, promising to pay back the mortgage loan.

"Before mortgage-backed securities, most mortgage loans were issued by the local savings & loan. So the note usually didn't go anywhere: it stayed in the offices of the S&L down the street.

"But once mortgage loan securitization happened, things got sloppy...they got sloppy by the very nature of mortgage-backed securities.

"The whole purpose of MBSs was for different investors to have their different risk appetites satiated with different bonds. Some bond customers wanted super-safe bonds with low returns, some others wanted riskier bonds with correspondingly higher rates of return.

"Therefore, as everyone knows, the loans were 'bundled' into REMICs (Real-Estate Mortgage Investment Conduits, a special vehicle designed to hold the loans for tax purposes), and then "sliced & diced"...split up and put into tranches, according to their likelihood of default, their interest rates, and other characteristics.

"This slicing and dicing created 'senior tranches,' where the loans would likely be paid in full, if the past history of mortgage loan statistics was to be believed. And it also created 'junior tranches,' where the loans might well default, again according to past history and statistics. (A whole range of tranches was created, of course, but for the purposes of this discussion we can ignore all those countless other variations.)

"These various tranches were sold to different investors, according to their risk appetite. That's why some of the MBS bonds were rated as safe as Treasury bonds, and others were rated by the ratings agencies as risky as junk bonds.

"But here's the key issue: When an MBS was first created, all the mortgages were pristine...none had defaulted yet, because they were all brand-new loans. Statistically, some would default and some others would be paid back in full...but which ones specifically would default? No one knew, of course. If I toss a coin 1,000 times, statistically, 500 tosses the coin will land heads...but what will the result be of, say, the 723rd toss? No one knows.

"Same with mortgages.

"So in fact, it wasn't that the riskier loans were in junior tranches and the safer ones were in senior tranches: rather, all the loans were in the REMIC, and if and when a mortgage in a given bundle of mortgages defaulted, the junior tranche holders would take the losses first, and the senior tranche holder last.

"But who were the owners of the junior-tranche bond and the senior-tranche bonds? Two different people. Therefore, the mortgage note was not actually signed over to the bond holder. In fact, it couldn't be signed over. Because, again, since no one knew which mortgage would default first, it was impossible to assign a specific mortgage to a specific bond.

"Therefore, how to make sure the safe mortgage loan stayed with the safe MBS tranche, and the risky and/or defaulting mortgage went to the riskier tranche?

"Enter stage right the famed MERS...the Mortgage Electronic Registration System.

"MERS was the repository of these digitized mortgage notes that the banks originated from the actual mortgage loans signed by homebuyers. MERS was jointly owned by Fannie Mae and Freddie Mac (yes, those two again ...I know, I know: like the chlamydia and the gonorrhea of the financial world...you cure 'em, but they just keep coming back).

"The purpose of MERS was to help in the securitization process. Basically, MERS directed defaulting mortgages to the appropriate tranches of mortgage bonds. MERS was essentially where the digitized mortgage notes were sliced and diced and rearranged so as to create the mortgage-backed securities. Think of MERS as Dr. Frankenstein's operating table, where the beast got put together.

"However, legally...and this is the important part...MERS didn't hold any mortgage notes: the true owner of the mortgage notes should have been the REMICs.

"But the REMICs didn't own the notes either, because of a fluke of the ratings agencies: the REMICs had to be "bankruptcy remote," in order to get the precious ratings needed to peddle mortgage-backed Securities to institutional investors.

"So somewhere between the REMICs and MERS, the chain of title was broken.

"Now, what does 'broken chain of title' mean? Simple: when a homebuyer signs a mortgage, the key document is the note. As I said before, it's the actual IOU. In order for the mortgage note to be sold or transferred to someone else (and therefore turned into a mortgage-backed security), this document has to be physically endorsed to the next person. All of these signatures on the note are called the 'chain of title.'

"You can endorse the note as many times as you please...but you have to have a clear chain of title right on the actual note: I sold the note to Moe, who sold it to Larry, who sold it to Curly, and all our notarized signatures are actually, physically, on the note, one after the other.

"If for whatever reason any of these signatures is skipped, then the chain of title is said to be broken. Therefore, legally, the mortgage note is no longer valid. That is, the person who took out the mortgage loan to pay for the house no longer owes the loan, because he no longer knows whom to pay.

"To repeat: if the chain of title of the note is broken, then the borrower no longer owes any money on the loan.

"Read that last sentence again, please. Don't worry, I'll wait.

"You read it again? Good: Now you see the can of worms that's opening up.

"The broken chain of title might not have been an issue if there hadn't been an unusual number of foreclosures. Before the housing bubble collapse, the people who defaulted on their mortgages wouldn't have bothered to check to see that the paperwork was in order.

"But as everyone knows, following the housing collapse of 2007-'10-and-counting, there has been a boatload of foreclosures...and foreclosures on a lot of people who weren't sloppy bums who skipped out on their mortgage payments, but smart and cautious people who got squeezed by circumstances.

"These people started contesting their foreclosures and evictions, and so started looking into the chain-of-title issue, and that's when the paperwork became important. So the chain of title became crucial and the botched paperwork became a nontrivial issue.

"Now, the banks had hired 'foreclosure mills'...law firms that specialized in foreclosures...in order to handle the massive volume of foreclosures and evictions that occurred because of the housing crisis. The foreclosure mills, as one would expect, were the first to spot the broken chain of titles.

"Well, what do you know, it turns out that these foreclosure mills might have faked and falsified documentation, so as to fraudulently repair the chain-of-title issue, thereby 'proving' that the banks had judicial standing to foreclose on delinquent mortgages. These foreclosure mills might have even forged the loan note itself...

"Wait, why am I hedging? The foreclosure mills did actually, deliberately, and categorically fake and falsify documents, in order to expedite these foreclosures and evictions. Yves Smith at Naked Capitalism, who has been all over this story, put up a price list for this 'service' from a company called DocX...yes, a price list for forged documents. Talk about your one-stop shopping!

"So in other words, a massive fraud was carried out, with the inevitable innocent bystanders getting caught up in the fraud: the guy who got foreclosed and evicted from his home in Florida, even though he didn't actually have a mortgage, and in fact owned his house free -and clear. The family that was foreclosed and evicted, even though they had a perfect mortgage payment record. Et cetera, depressing et cetera.

"Now, the reason this all came to light is not because too many people were getting screwed by the banks or the government or someone with some power saw what was going on and decided to put a stop to it...that would have been nice, to see a shining knight in armor, riding on a white horse.

"But that's not how America works nowadays.

"No, alarm bells started going off when the title insurance companies started to refuse to insure the titles.

"In every sale, a title insurance company insures that the title is free -and clear ...that the prospective buyer is in fact buying a properly vetted house, with its title issues all in order. Title insurance companies stopped providing their service because...of course...they didn't want to expose themselves to the risk that the chain of title had been broken, and that the bank had illegally foreclosed on the previous owner.

"That's when things started getting interesting: that's when the attorneys general of various states started snooping around and making noises (elections are coming up, after all).

"The fact that Ally Financial (formerly GMAC), JP Morgan Chase, and now Bank of America have suspended foreclosures signals that this is a serious problem...obviously. Banks that size, with that much exposure to foreclosed properties, don't suspend foreclosures just because they're good corporate citizens who want to do the right thing, and who have all their paperwork in strict order...they're halting their foreclosures for a reason.

"The move by the United States Congress last week, to sneak by the Interstate Recognition of Notarizations Act? That was all the banking lobby. They wanted to shove down that law, so that their foreclosure mills' forged and fraudulent documents would not be scrutinized by out-of-state judges. (The spineless cowards in the Senate carried out their master's will by a voice vote...so that there would be no registry of who had voted for it, and therefore no accountability.)

"And President Obama's pocket veto of the measure? He had to veto it...if he'd signed it, there would have been political hell to pay, plus it would have been challenged almost immediately, and likely overturned as unconstitutional in short order. (But he didn't have the gumption to come right out and veto it...he pocket vetoed it.)

"As soon as the White House announced the pocket veto...the very next day!...Bank of America halted all foreclosures, nationwide.

"Why do you think that happened? Because the banks are in trouble...again. Over the same thing as last time...the damned mortgage-backed securities!

"The reason the banks are in the tank again is, if they've been foreclosing on people they didn't have the legal right to foreclose on, then those people have the right to get their houses back. And the people who bought those foreclosed houses from the bank might not actually own the houses they paid for.

"And it won't matter if a particular case...or even most cases...were on the up -and up: It won't matter if most of the foreclosures and evictions were truly due to the homeowner failing to pay his mortgage. The fraud committed by the foreclosure mills casts enough doubt that, now, all foreclosures come into question. Not only that, all mortgages come into question.

"People still haven't figured out what all this means. But I'll tell you: if enough mortgage-paying homeowners realize that they may be able to get out of their mortgage loans and keep their houses, scott-free? That's basically a license to halt payments right now, thank you. That's basically a license to tell the banks to take a hike.

"What are the banks going to do...try to foreclose and then evict you? Show me the paper, Mr. Banker, will be all you need to say.

"This is a major, major crisis. The Lehman bankruptcy could be a spring rain compared to this hurricane. And if this isn't handled right...and handled right quick, in the next couple of weeks at the outside...this crisis could also spell the end of the mortgage business altogether. Of banking altogether. Hell, of civil society. What do you think happens in a country when the citizens realize they don't need to pay their debts?"

This is very long, but I think it's extremely important that you ready every word of it:

"Homeowners can only be foreclosed and evicted from their homes by the person or institution who actually has the loan paper...only the note-holder has legal standing to ask a court to foreclose and evict. Not the mortgage, the note, which is the actual IOU that people sign, promising to pay back the mortgage loan.

"Before mortgage-backed securities, most mortgage loans were issued by the local savings & loan. So the note usually didn't go anywhere: it stayed in the offices of the S&L down the street.

"But once mortgage loan securitization happened, things got sloppy...they got sloppy by the very nature of mortgage-backed securities.

"The whole purpose of MBSs was for different investors to have their different risk appetites satiated with different bonds. Some bond customers wanted super-safe bonds with low returns, some others wanted riskier bonds with correspondingly higher rates of return.

"Therefore, as everyone knows, the loans were 'bundled' into REMICs (Real-Estate Mortgage Investment Conduits, a special vehicle designed to hold the loans for tax purposes), and then "sliced & diced"...split up and put into tranches, according to their likelihood of default, their interest rates, and other characteristics.

"This slicing and dicing created 'senior tranches,' where the loans would likely be paid in full, if the past history of mortgage loan statistics was to be believed. And it also created 'junior tranches,' where the loans might well default, again according to past history and statistics. (A whole range of tranches was created, of course, but for the purposes of this discussion we can ignore all those countless other variations.)

"These various tranches were sold to different investors, according to their risk appetite. That's why some of the MBS bonds were rated as safe as Treasury bonds, and others were rated by the ratings agencies as risky as junk bonds.

"But here's the key issue: When an MBS was first created, all the mortgages were pristine...none had defaulted yet, because they were all brand-new loans. Statistically, some would default and some others would be paid back in full...but which ones specifically would default? No one knew, of course. If I toss a coin 1,000 times, statistically, 500 tosses the coin will land heads...but what will the result be of, say, the 723rd toss? No one knows.

"Same with mortgages.

"So in fact, it wasn't that the riskier loans were in junior tranches and the safer ones were in senior tranches: rather, all the loans were in the REMIC, and if and when a mortgage in a given bundle of mortgages defaulted, the junior tranche holders would take the losses first, and the senior tranche holder last.

"But who were the owners of the junior-tranche bond and the senior-tranche bonds? Two different people. Therefore, the mortgage note was not actually signed over to the bond holder. In fact, it couldn't be signed over. Because, again, since no one knew which mortgage would default first, it was impossible to assign a specific mortgage to a specific bond.

"Therefore, how to make sure the safe mortgage loan stayed with the safe MBS tranche, and the risky and/or defaulting mortgage went to the riskier tranche?

"Enter stage right the famed MERS...the Mortgage Electronic Registration System.

"MERS was the repository of these digitized mortgage notes that the banks originated from the actual mortgage loans signed by homebuyers. MERS was jointly owned by Fannie Mae and Freddie Mac (yes, those two again ...I know, I know: like the chlamydia and the gonorrhea of the financial world...you cure 'em, but they just keep coming back).

"The purpose of MERS was to help in the securitization process. Basically, MERS directed defaulting mortgages to the appropriate tranches of mortgage bonds. MERS was essentially where the digitized mortgage notes were sliced and diced and rearranged so as to create the mortgage-backed securities. Think of MERS as Dr. Frankenstein's operating table, where the beast got put together.

"However, legally...and this is the important part...MERS didn't hold any mortgage notes: the true owner of the mortgage notes should have been the REMICs.

"But the REMICs didn't own the notes either, because of a fluke of the ratings agencies: the REMICs had to be "bankruptcy remote," in order to get the precious ratings needed to peddle mortgage-backed Securities to institutional investors.

"So somewhere between the REMICs and MERS, the chain of title was broken.

"Now, what does 'broken chain of title' mean? Simple: when a homebuyer signs a mortgage, the key document is the note. As I said before, it's the actual IOU. In order for the mortgage note to be sold or transferred to someone else (and therefore turned into a mortgage-backed security), this document has to be physically endorsed to the next person. All of these signatures on the note are called the 'chain of title.'

"You can endorse the note as many times as you please...but you have to have a clear chain of title right on the actual note: I sold the note to Moe, who sold it to Larry, who sold it to Curly, and all our notarized signatures are actually, physically, on the note, one after the other.

"If for whatever reason any of these signatures is skipped, then the chain of title is said to be broken. Therefore, legally, the mortgage note is no longer valid. That is, the person who took out the mortgage loan to pay for the house no longer owes the loan, because he no longer knows whom to pay.

"To repeat: if the chain of title of the note is broken, then the borrower no longer owes any money on the loan.

"Read that last sentence again, please. Don't worry, I'll wait.

"You read it again? Good: Now you see the can of worms that's opening up.

"The broken chain of title might not have been an issue if there hadn't been an unusual number of foreclosures. Before the housing bubble collapse, the people who defaulted on their mortgages wouldn't have bothered to check to see that the paperwork was in order.

"But as everyone knows, following the housing collapse of 2007-'10-and-counting, there has been a boatload of foreclosures...and foreclosures on a lot of people who weren't sloppy bums who skipped out on their mortgage payments, but smart and cautious people who got squeezed by circumstances.

"These people started contesting their foreclosures and evictions, and so started looking into the chain-of-title issue, and that's when the paperwork became important. So the chain of title became crucial and the botched paperwork became a nontrivial issue.

"Now, the banks had hired 'foreclosure mills'...law firms that specialized in foreclosures...in order to handle the massive volume of foreclosures and evictions that occurred because of the housing crisis. The foreclosure mills, as one would expect, were the first to spot the broken chain of titles.

"Well, what do you know, it turns out that these foreclosure mills might have faked and falsified documentation, so as to fraudulently repair the chain-of-title issue, thereby 'proving' that the banks had judicial standing to foreclose on delinquent mortgages. These foreclosure mills might have even forged the loan note itself...

"Wait, why am I hedging? The foreclosure mills did actually, deliberately, and categorically fake and falsify documents, in order to expedite these foreclosures and evictions. Yves Smith at Naked Capitalism, who has been all over this story, put up a price list for this 'service' from a company called DocX...yes, a price list for forged documents. Talk about your one-stop shopping!

"So in other words, a massive fraud was carried out, with the inevitable innocent bystanders getting caught up in the fraud: the guy who got foreclosed and evicted from his home in Florida, even though he didn't actually have a mortgage, and in fact owned his house free -and clear. The family that was foreclosed and evicted, even though they had a perfect mortgage payment record. Et cetera, depressing et cetera.

"Now, the reason this all came to light is not because too many people were getting screwed by the banks or the government or someone with some power saw what was going on and decided to put a stop to it...that would have been nice, to see a shining knight in armor, riding on a white horse.

"But that's not how America works nowadays.

"No, alarm bells started going off when the title insurance companies started to refuse to insure the titles.

"In every sale, a title insurance company insures that the title is free -and clear ...that the prospective buyer is in fact buying a properly vetted house, with its title issues all in order. Title insurance companies stopped providing their service because...of course...they didn't want to expose themselves to the risk that the chain of title had been broken, and that the bank had illegally foreclosed on the previous owner.

"That's when things started getting interesting: that's when the attorneys general of various states started snooping around and making noises (elections are coming up, after all).

"The fact that Ally Financial (formerly GMAC), JP Morgan Chase, and now Bank of America have suspended foreclosures signals that this is a serious problem...obviously. Banks that size, with that much exposure to foreclosed properties, don't suspend foreclosures just because they're good corporate citizens who want to do the right thing, and who have all their paperwork in strict order...they're halting their foreclosures for a reason.

"The move by the United States Congress last week, to sneak by the Interstate Recognition of Notarizations Act? That was all the banking lobby. They wanted to shove down that law, so that their foreclosure mills' forged and fraudulent documents would not be scrutinized by out-of-state judges. (The spineless cowards in the Senate carried out their master's will by a voice vote...so that there would be no registry of who had voted for it, and therefore no accountability.)

"And President Obama's pocket veto of the measure? He had to veto it...if he'd signed it, there would have been political hell to pay, plus it would have been challenged almost immediately, and likely overturned as unconstitutional in short order. (But he didn't have the gumption to come right out and veto it...he pocket vetoed it.)

"As soon as the White House announced the pocket veto...the very next day!...Bank of America halted all foreclosures, nationwide.

"Why do you think that happened? Because the banks are in trouble...again. Over the same thing as last time...the damned mortgage-backed securities!

"The reason the banks are in the tank again is, if they've been foreclosing on people they didn't have the legal right to foreclose on, then those people have the right to get their houses back. And the people who bought those foreclosed houses from the bank might not actually own the houses they paid for.

"And it won't matter if a particular case...or even most cases...were on the up -and up: It won't matter if most of the foreclosures and evictions were truly due to the homeowner failing to pay his mortgage. The fraud committed by the foreclosure mills casts enough doubt that, now, all foreclosures come into question. Not only that, all mortgages come into question.

"People still haven't figured out what all this means. But I'll tell you: if enough mortgage-paying homeowners realize that they may be able to get out of their mortgage loans and keep their houses, scott-free? That's basically a license to halt payments right now, thank you. That's basically a license to tell the banks to take a hike.

"What are the banks going to do...try to foreclose and then evict you? Show me the paper, Mr. Banker, will be all you need to say.

"This is a major, major crisis. The Lehman bankruptcy could be a spring rain compared to this hurricane. And if this isn't handled right...and handled right quick, in the next couple of weeks at the outside...this crisis could also spell the end of the mortgage business altogether. Of banking altogether. Hell, of civil society. What do you think happens in a country when the citizens realize they don't need to pay their debts?"

October 10, 2010

Some Pain to Come

The slides below are from a presentation delivered on October 6, 2010 by Chris Whalen with the American Enterprise Institute.

Subscribe to:

Posts (Atom)