September 30, 2009

Dr. J on Truth of Christianity and Miracles

September 29, 2009

Is Basic Economics Intuitive?

Intuitive version: We'd be better off if other countries gave us stuff for free. Isn't "really cheap"

the next-best thing?

2. Counterintuitive claim: Strict labor market regulation is bad for workers.

Intuitive version: Employers don't like hiring people if it's hard to get rid of them. Suppose you had to marry anyone you asked out on a date!

3. Counterintuitive claim: Egalitarian socialism creates poverty... even starvation.

Intuitive version: If everyone gets the same share whether or not they work, you're asking people to work for free. People don't like working for free, especially when the work isn't very fun. (This is my response to Sumner's Great Leap Forward Challenge: "But how do we explain to school children that millions had to starve because of a policy that encouraged people to share?")

4. Counterintuitive claim: Prices are determined by supply and demand.

Intuitive version: If the good were free, consumers would want a lot, but producers wouldn't feel like making much. If the good cost trillions of dollars, producers would want to make a lot, but consumers wouldn't want to buy any. In between there's got to be a price where consumers want to buy as much as producers want to make.

Endure Like Daniel

When tempted to despair about present rulers, dare to endure like Daniel.

When tempted to compromise in small things, dare to endure like Daniel.

When tempted to weariness by pagan culture, dare to endure like Daniel.

When tempted to doubt God’s promises, dare to endure like Daniel.

When tempted to flatter our rulers, dare to endure like Daniel.

When tempted to withdraw from public life, dare to endure like Daniel.

September 28, 2009

Phil Valentine on Useless Wars

And where has that war on poverty gotten us? Although LBJ proposed it in 1964, the programs were not fully implemented until 1968. The percentage of people living below the poverty level was 12.8 percent. The latest statistics put that number at 12.3 percent.

Nearly $16 trillion down the drain and nothing to show for it. Wait a minute, I take that back. We do have something to show for it. We have millions trapped in cyclical dependency on the government and the illegitimacy rate in the black community is now 70 percent; 25 percent in the white community."

Valentine, like many conservative talk-radio hosts, can be a bit of a blowhard, but that fact doesn't take away from the veracity of his opinion piece.

There is also one other thing that has really bugged me since Obama took office. Where are the war protesters now? Where are the posters depicting Obama as Hitler? Where is the talk about prosecuting the President of the United States for war crimes? Because the last time I looked, President Obama wasn't pulling troops from Iraq and Afghanistan. The last time I looked, President Obama hasn't stopped spending money fighting terrorism at home or abroad. In fact, the last time I looked President Obama was increasing troop levels in Afghanistan and continuing White House support of programs like the Patriot Act.

The real "useless war" is not being fought in Iraq or Afghanistan. The real useless war is being fought right here in the United States by a bloated, inefficient, and bureaucratic federal government.

If we want to actually decrease poverty in this country, we need to all get up off our fat butts and do something about it as INDIVIDUALS. I am so sick of looking to the government and politicians for answers.

Draw It In the Dirt

He's always involved. He's involved in every play that's called. That one, like I said, we just kind of drew it up there on the sidelines and made it work.

September 27, 2009

Where have you gone.........President Madison

September 24, 2009

Last Embassy Rocks!

In the Political-Economy argument of "expensive health insurance", if the term "expensive" is more related to "solvency" (Economics) than related to "Populism" (Politics), then "expensive" might be better distinguished as funded and solvent.

Those same Private Plans are the plans that leave no unfunded items to your children, grandchildren, and so on into the future. Why? Because they are Private Sector plans that are funded insurance plans.

Think for a moment about funded insurance plans. Real insurance plans. They do not come cheap! However, as a consumer of insurance, you purchased health insurance, as well as other types of insurance, so that you do not leave anyone with unmanageable future obligations, including yourself.

A wise question to ask yourself is: if the three major Socialized Schemes in the United States have a current track record of being underfunded by $53 Trillion, what would be the direction of the funding/underfunding of a Socialized Medicine Scheme?

September 22, 2009

Netflix and Generous Severance

September 20, 2009

Worry

Insurance Industry Expert on Real Costs of Socialized Medicine

The sales pitch of low out-of-pocket costs, like any "sales pitch", omits the remainder of the story. The remainder of the story is that low out-of-pocket costs translates into very high premium costs.

Nassim Taleb Interview

MW: Are you saying the U.S. shouldn't have done all those bailouts? What was the alternative?

Taleb: Blood , sweat and tears. A lot of the growth of the past few years was fake growth from debt. So swallow the losses, be dignified and move on. Suck it up. I gather you're not too impressed with the folks in Washington who are handling this crisis.

Ben Bernanke saved nothing! He shouldn't be allowed in Washington. He's like a doctor who misses the metastatic tumour and says the patient is doing very well. The first thing I would tell Chinese officials is, how can you buy U.S. bonds as long as Larry Summers is there? He's a textbook case of overconfidence. Look what happened to Harvard's finances. They took a lot of risk they didn't understand, and it was a disaster. That's the Larry Summers mentality.

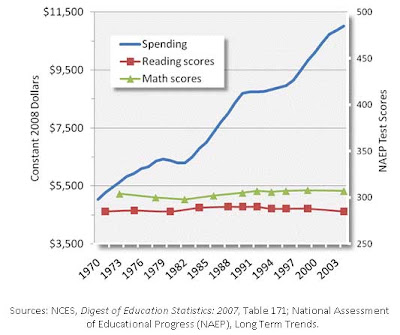

Drunken Sailors - In Graph Form

The More Things Change, The More They.....

September 15, 2009

Winston and Clemmie

Good bye.

W.

September 13, 2009

Too Big Too Fail - Ferguson Doesn't Think So

September 10, 2009

Drunken Sailors - A History

Please, please, pretty please read this incredible piece by John Steele Gordon on The Sorry Tale of America's Out-of-Control Spending.

From the piece:

At the end of fiscal 2008, which came on September 30 of last year, the American national debt stood at $9.6 trillion. That sum is, perhaps, quite beyond the imagining of most people. It is, after all, 250 million times the average per capita income. Even the total fortunes of the entire Forbes 400 list add up to less than 15 percent of it. To use a journalistic measure that dates back to the late 18th century—when the British national debt had become a major political issue in that country—if you laid 9.6 trillion silver dollars end to end, they would reach to the sun and back, with enough left over to wrap around the Earth more than 1,700 times.

.......The bad news is that the debt is rapidly rising, both in absolute terms and relative to GDP, thanks to the current recession, the stimulus effort to end that recession, and the bailout of the country’s financial system. The budget deficit for fiscal 2009 is estimated to be a staggering $1.6 trillion, larger than the entire national debt as recently as 1984. It is the largest peacetime deficit (measured as a percentage of federal revenues) since 1936, when the country was still in the throes of a far worse economic downturn. The deficit will cause the ratio of debt to GDP to rise to over 80 percent by the end of fiscal 2009. That will be the highest it has been since 1950.

.....The U.S. debt exploded in the last half-century from a fateful intersection of 1) a national economic trauma; 2) a fundamental change in the prevailing economic theory; 3) ill-considered political fund raising reforms after Watergate; and 4) reforms in Congress that made spending impossible to control.

......Roosevelt, in office, quickly accepted the need for “passive deficits,” those resulting from the poor economy. Then in 1936 John Maynard Keynes published The General Theory of Employment, Interest, and Money. Keynes argued that while supply and demand must balance in the long run, in the long run, as he famously quipped, “we are all dead.” In the short run, Keynes thought aggregate supply can outstrip demand (producing depression) or vice versa (producing inflation).

Keynes argued for “active deficits”—deliberate spending in deficit to increase demand and bring the economy into balance in times of depression. Keynes also argued, of course, that when the economy overheated, the government should be in surplus to soak up excess demand.

Economists took to Keynesianism immediately. It is not hard to see why. First, it gave economists a powerful new analytical tool. Second, it greatly increased the power and influence of economists. Before Keynes, presidents had not needed economists any more than they had needed astronomers. But if government was now to be the engineer of the national economic locomotive, revving and braking through Keynesian means as needed, then government needed experts to guide it.

.....Campaign finance reform after the Watergate scandal brought the political action committee system into being, making, in effect, lobbyists major funders of political campaigns. Naturally the lobbyists were interested in federal spending, not federal fiscal restraint.

The budget and the debt exploded. Like an alcoholic trying to quit drinking, Washington tried to reform itself with a series of budget deals and “summits.” None of it worked, as Congress, like the alcoholic, kept making one-time exceptions to the rules.

What goes for football, goes for....

September 9, 2009

Paradigm Shift?

Government - Getting Results?

September 7, 2009

50 Things Being Killed by the Internet

Twitter has become a clearing-house for jokes about dead famous people. Tasteless, but an antidote to the "fans in mourning" mawkishness that otherwise predominates

Email is quicker, cheaper and more convenient; receiving a handwritten letter from a friend has become a rare, even nostalgic, pleasure. As a result, formal valedictions like "Yours faithfully" are being replaced by "Best" and "Thanks"

When almost any fact, no matter how obscure, can be dug up within seconds through Google and Wikipedia, there is less value attached to the "mere" storage and retrieval of knowledge. What becomes important is how you use it – the internet age rewards creativity

After typing the digits into your contacts book, you need never look at them again.

The proliferation of health websites has undermined the status of GPs, whose diagnoses are now challenged by patients armed with printouts.

How can you forge a new identity at university when your Facebook is plastered with photos of the "old" you?

You've spent the past five years tracking their weight-gain on Facebook, so meeting up with your first love doesn't pack the emotional punch it once did.

Some gift horses should have their mouths very closely inspected.

A Great Coach

Gentlemen,

My name is R. Stephen Prather, and I am writing to encourage you to induct Coach Ron Bell of Marist High School into the Georgia Coaches’ Hall of Fame.

I had the extreme honor and sometime pleasure (Coach Bell didn’t like losing very much) of playing for Coach Bell from 1993 – 1997. As a freshman at Marist, I was a member of the ’94 State Championship team that went 32-0 and finished the season ranked in the top ten nationally. Coach Bell was rightly awarded the National Coach of the Year award for that ’94 perfect season.

I have played sports all of my life. My earliest memories are of sports. I was blessed to letter in both basketball and baseball at Marist and was able to earn a baseball scholarship to Vanderbilt University. Throughout the more than 25 years I have played team sports, I have had plenty of good coaches, bad coaches, and mediocre coaches. However, I have only had one great and unforgettable coach and that coach was Ron Bell.

I don’t know what specific criteria your committee uses to judge coaches, but I have always judged coaches by three distinct criteria.

1) Wins and Losses: No matter how hard we try, we can’t separate coaching from wins and losses. If you don’t win, it is hard to make the argument that you were a great coach. John Wooden was a great and faithful man and had a profound impact on the lives of those who played for him. However, would John Wooden be John Wooden if his career record wasn’t 664 wins and 162 losses? When it comes to wins and losses, I think Coach Bell passes with flying colors. Coach Bell had a career record of 616 wins and 199 losses. Of the 815 high school games Coach Bell coached in, he came out victorious more than 75% of the time. Over a 25 year career, I think it is fair to say this is record is quite remarkable.

2) Impact on his Players: Great and legendary coaches have a lifetime impact on the players that come through their program. It has been 13 years since I played for Coach Bell, but I recently found myself retelling a Coach Bell story to one of my co-workers. Coach Bell once made our entire gym class sit in the men’s restroom for the entirety of the fifty-five minute gym period because we refused to regularly flush the gym’s “commodes”. Coach Bell’s reason for this punishment was classic Ron Bell: “WINNERS FLUSH COMMODES!” To this day, I have never forgotten these words. Every time I want to take a short cut in life, give a half-cocked effort, or make an excuse for not following through on something, I remember that “WINNERS FLUSH COMMODES!” Outside of my immediate family, Coach Bell has had as much of an impact on my character development as anyone. He taught me how to be a man and how to win with grace and lose with grit and determination. I often thank God for putting Coach Bell in my path.

3) Impact on his Program: There are certain coaches that define a program. When you think of Penn State football, the name Joe Paterno comes to mind. When you think of UNC basketball, the name Dean Smith comes to mind. Well, if you ask an ’84, ’94, and ’04 Marist Alum to describe Marist basketball, I am fairly confident you would receive the same answer: Ron Bell.

Whether it was putting together a twenty page scouting report on our opponent, watching endless (and I mean endless) hours of film, or sleeping an entire week on the floor of his modest office, Coach Bell did everything he could to give us the best opportunity to succeed. We never lost a game because we weren’t prepared or because we didn’t have the proper game plan. In fact, any one that watched Marist absolutely destroy a far superior Lithonia team in the ’94 State Championship game knows that when it came to game planning, Ron Bell had no equal.

I could tell a thousand more stories and give countless additional examples of Coach Bell’s greatness, but I think you get the picture. If you wait another hundred years, I don’t believe you will find another coach more deserving of this honor than Coach Ron Bell.

Thank you for your time in reading this letter, and please do not hesitate to contact me if you have any questions or need any additional information.

September 4, 2009

Coburn Townhall Answer on Public Option

REITs In Trouble?

The issue facing REITs parallels that of the banks: an industry-wide solvency crisis. Only REITs lack access to enormous subsidies from the Federal Reserve, which include the manipulation of borrowing rates down to the range of 1%, resulting in a profitable spread on new lending.

If you carefully consider the combined statistics on commercial mortgage debt, equity, and future rental cash flows, you come to the conclusion that the value of many REITs is permanently impaired. Even if a core group of higher-quality REITs escapes bankruptcy, their equity will still be impaired because lenders will only refinance properties on very tight terms: strict covenants, high interest rates, and requirements of hefty equity infusions into upside-down properties. This is a transfer of wealth from REIT shareholders to creditors. This wealth transfer is occurring through many channels, but the most important one relates to claims on future rental cash flow, which will be bleak regardless of who owns it:

- Creditors will take a higher share of those rental cash flows via higher interest rates

- Of the cash flows that trickle down to shareholders, they will be divided up among more and more REIT shares as we see more and more dilutive secondary offerings

September 3, 2009

No More Wet Blankets

Most Important Meal of the Day

'1st Tray. Poached egg, Toast, Jam, Butter, Coffee and milk, Jug of cold milk, Cold Chicken or Meat.

'2nd Tray. Grapefruit, Sugar Bowl, Glass orange squash (ice), Whisky soda.' He then adds: 'Wash hands, cigar.'

Sounds like a pretty dang good breakfast to me.