July 31, 2009

Stats on Our Side

Bigger Can Mean Better - At Least in CRE

July 30, 2009

Five W's

Blowing a hole in PowerPoint

Some of the highlights from the article:

Every year, the services spend millions of dollars teaching our people how to think. We invest in everything from war colleges to noncommissioned officer schools. Our senior schools in particular expose our leaders to broad issues and historical insights in an attempt to expose the complex and interactive nature of many of the decisions they will make.

......PowerPoint has clearly decreased the quality of the information provided to the decision-maker, but the damage doesn’t end there. It has also changed the culture of decision-making. In my experience, pre-PowerPoint staffs prepared two to four decision papers a day because that’s as many as most bosses would accept. These would be prepared and sent home with the decision-maker and each staff member that would participate in the subsequent discussion. Because of the tempo, most decision-makers did not take on more than three or four a day simply because of the requirement to read, absorb, think about and then be prepared to discuss the issue the following day. As an added benefit for most important decisions, they “slept on it.”

OUCH!

July 29, 2009

FSBO?

"Homer: And you didn't think I'd make any money. I found a dollar while I was waiting for the bus." [Homer triumphantly shows the one dollar bill he found for Marge]

Marge: While you were out earning that dollar, you lost forty dollars by not going to work. "

July 28, 2009

Getting Fleeced

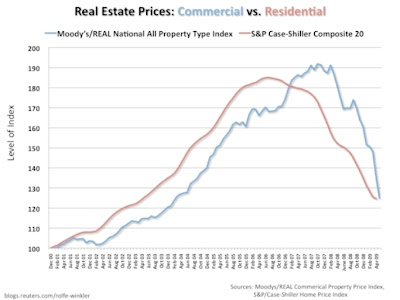

The Lag of Commercial Real Estate

July 27, 2009

Leasing 101 - Part 8

8) BATNA: Gotta love acronyms

- Best Alternative To a Negotiated Agreement

- Always have an alternative to consider

- If you think your current landlord is going to give you a deal on a lease renewal, you may be playing with fire

- Know the market and have alternatives.

- This will also increase your leverage and allow you to understand whether or not you are getting a deal that makes sense for your company

CRE Update

July 26, 2009

AMH - RIP

July 25, 2009

More than meets the emotional eye

July 24, 2009

What was true then........

July 23, 2009

Small Biz by the Numbers

89% had less than 20 employees

79% had less than 10 employees

61% had less than five employees.

Big Ben on CRE

July 22, 2009

Something to keep in mind......

"The American people will never knowingly adopt Socialism. But under the name of 'liberalism' they will adopt every fragment of the Socialist program, until one day America will be a Socialist nation, withoutknowing how it happened."

Norman Thomas, six-time candidate for President of the United States for the Socialist Party of America, made the above statement in a interview in 1948.

If you need a reminder of the definition of socialism, here you go:

Socialism refers to any one of various theories of economic organization advocating public or collective ownership and administration of the means of production and distribution of goods, and a society characterized by equal access to resources for all individuals with a more egalitarian method of compensation.

CRE - Good Bad News

From the DOW JONES NEWSWIRES:

Commercial real-estate prices fell 7.6% in May, according to Moody's Investors Service, as both dollar volume and transaction count reached record lows in the nine-year history of the firm's Commercial Property Price Indices.

The indexes are down 29% from a year ago and 35% from their October 2007 peak.

The commercial real-estate sector has suffered since mid-2008 as the recession deepened, vacancies increased and new owners have been unable to refinance mortgages. Retail and hotel properties have been hit especially hard in the commercial sector.

"Large commercial real-estate price declines in the last two months suggest that a bottom may be starting to form, although higher transaction volumes would be necessary in order to draw any definite conclusions," Moody's Managing Director Nick Levidy said.

Office buildings fared worst, dropping 29% from a year earlier, while industrial buildings were the best performers, down 12%. Apartment buildings in the South suffered a 21% drop, with a 23% slide in Florida, one of the worst-hit states by the housing crisis and global recession.

The sooner we can get to the bottom, the sooner we can start climbing back to a new top.

July 21, 2009

Are You Serious?

July 20, 2009

Tom Barrack - CRE Market Update

Why is it so hard to get new funding?

Partly because new equity is needed from the owner to provide any loan because the underlying real estate is 30%-50% less valuable than it was at the time of origination. Where is that going to come from? Everybody's tapped out. All the real estate guys have gone from G4's to electric golf carts.

The object of the drill for everyone in commercial real estate--and this is everyone in the world--is just get to the other side of Death Valley. If you can make it to the other side of Death Valley, there's hope. But even when the economy does start to roll out, commercial real estate takes a while behind the tail of that economy to catch up.

Is the CMBS market more complex than the residential mortgage-backed securities market?

Yes. You have a multitude of tenants and you have a multitude of income streams and thousands of varying properties. You have to be a nuclear physicist to understand the architecture of what happens in the event of default on these deals. It's all untested.

Where is the opportunity for smart investors right now?

The new equity in real estate is buying and restructuring debt. The rescue business is the business of the moment.

What's your outlook for the American economy?

When we shift all our energy from all the whining and crying and entitlement of what the past was, we're going to figure it out. American ingenuity and entrepreneurism is the best of brand everywhere in the world. The good news is nobody made a mistake, everybody's net worth got wiped out together on a no-fault basis. We all got marked to market together.

GAG!

Banks, Battles, and Overconfidence

July 19, 2009

Suffering Well

July 18, 2009

Rationality

......to behaviouralists it's no surprise to find investors behaving irrationally. James Montier, formerly of Société Générale, points to an experiment he took part in involving over 1,000 players who were asked to pick a number between 0 and 100 that they believed would be close to two-thirds of the average number picked.

There's no correct answer – it depends on what others do. But there is a clear maximum answer: 67, which would require every other player to have chosen 100. What was "more than slightly alarming" was that there were a large number of answers above 67. All 1,000 players were professional investors.

This goes a long way in helping understand just why Montier is so fervently opposed to the Efficient Market Hypothesis

Leasing 101 - Part 7

7) Base Year: Much more important than you ever thought

- In most modified gross leases, the rent includes the costs of providing all of the normal building services,and the tenant is required to pay the landlord for its pro-rata share of increases in the costs of such services over time.

- Because the Base Year is used each year to measure cost increases, it is imperative that the Base Year be reflective of what it normally costs to run the building.

Marks' Memos

July 17, 2009

Give 'Em Hell Zell

July 16, 2009

P.T. Barnum and The Art of Money Getting

When President Lincoln and his family entertained the world famous General Tom Thumb (made world famous by Mr. Barnum himself), Lincoln

“Mr. President,” Tom replied, “my friend Barnum could settle the whole thing in a month.”

The more I read about P.T. Barnum, the more I am amazed at what he was able to accomplish throughout his life. He was a prolific writer, a journalist, a dynamic speaker, a master marketer, a millionaire, a politician, an abolitionist, a best-selling author, a maker of men and women, and founder of the Greatest Show on Earth.

Here is a link one of Mr. Barnum’s most famous speeches. The speech is entitled “The Art of Money Getting.” The speech was given well over 100 years ago and there is not a lesson that doesn’t directly apply today.

Please take time to read this speech. I definitely think you will find it as useful and powerful as I did.

Here are some of favorite excerpts of the speech:

Those who really desire to attain an independence, have only to set their minds upon it, and adopt the proper means, as they do in regard to any other object which they wish to accomplish, and the thing is easily done. But however easy it may be found to make money, I have no doubt many of my hearers will agree it is the most difficult thing in the world to keep it. The road to wealth is, as Dr. Franklin truly says, "as plain as the road to the mill." It consists simply in expending less than we earn.

The safest plan, and the one most sure of success for the young man starting in life, is to select the vocation which is most congenial to his tastes.

Young men starting in life should avoid running into debt. There is scarcely anything that drags a person down like debt.

Work at it, if necessary, early and late, in season and out of season, not leaving a stone unturned, and never deferring for a single hour that which can be done just as well now.

I hold that every man should, like Cuvier, the French naturalist, thoroughly know his business.

So in regard to wealth. Go on in confidence, study the rules, and above all things, study human nature.

Men should be systematic in their business. A person who does business by rule, having a time and place for everything, doing his work promptly, will accomplish twice as much and with half the trouble of him who does it carelessly and slipshod.

Politeness and civility are the best capital ever invested in business.

Montier's Nine Rules

1. Value, value, value

The price I pay for an investment determines its likely return. No asset is so good as to be immune from the possibility of overvaluation, and few assets are so bad as to be exempt from the possibility of undervaluation.

Investments should be purchased with a margin of safety. Any estimate of intrinsic value will only prove to be correct via the intervention of luck, so buying only when a large discount to that estimate is available offers protection against being wrong.

2. Be contrarian

As Sir John Templeton observed: "It is impossible to produce superior performance unless you do something different from the majority." Following a value-oriented approach will almost certainly lead you to a contrarian stance because you are generally buying the unloved assets and selling the market's darlings.

3. Be patient

As Ben Graham wrote: "Undervaluations caused by neglect or prejudice may persist for an inconveniently long time and the same applies to inflated prices caused by over-enthusiasm or artificial stimulants."

Cheap stocks can always get cheaper and expensive stocks can get more expensive, so patience is required.

4. Be unconstrained

Many professional managers are forced to be specialist, but they should have the freedom to invest where they think the opportunities lie. There may be times, such as last year, when my analysis tells me the best place to be is net short. Early last year, my screens were throwing up the highest number of short ideas I have ever seen.

5. Don't forecast

The folly of forecasting is one of my pet hobby-horses. I can't understand why so many investors spend so much time engaged in an activity that has so little value, and so little chance of success.

6. Cycles matter

As Howard Marks of Oaktree Capital puts it, we may not be able to predict, but we can prepare. All sorts of cycles exist – economic, credit and sentiment to name but three.

7. History matters

Sir John Templeton also observed that: "This time is different" were the four most dangerous words in investing.

8. Be sceptical

Bruce Springsteen once remarked that: "Blind faith in anything will get you killed." I share this view on the dangers of the lack of critical thinking.

9. Be top-down and bottom-up

While stock selection is best approached from the bottom up, ignoring the top-down can be extraordinarily expensive. The last year has been a perfect example of why understanding the top-down can benefit and inform the bottom-up.

Commercial Closings by the Numbers

July 15, 2009

Leasing 101 - Part 6

6) Operating Expenses: Management matters

- Before you sign a lease, have your broker ask to see a copy of the expense statement from the previous three years.

- Have expenses been increasing from year-to-year?

- If so, find out why?

- Ask to see an operating budget for the current year.

- What is the CAM or Load factor for the building?

- How does the Landlord define operating expenses?

- Who manages the building?

- What is the management company’s reputation?

- Have you talked to existing tenants about the building’s management?

- A building that is poorly managed is a bad building.

July 14, 2009

Market Musings

Big Jim Boss

You don't tug on Superman's cape

You don't spit into the wind

You don't pull the mask off the old Lone Ranger

And you don't mess around with Jim, da do da do...